30+ mortgage debt to income ratio

Get Instantly Matched with Your Ideal 30 Year Mortgage Lender. Ad Compare the best personal loans for debt consolidation good credit home repair and more.

How To Calculate Debt To Income Ratio For A Mortgage Or Loan

Ad 30 Year Mortgage Rates Compared.

. Get Instantly Matched with Your Ideal 30 Year Mortgage Lender. Web price-rent 38 and debt-to-household-income 47 ratios from the recent boom episode while relaxation of loan-to-value standards generates a much smaller boom. Web Lenders prefer to see a debt-to-income ratio smaller than 36 with no more than 28 of that debt going towards servicing your mortgage.

Web Debt-to-income ratio DTI is the ratio of total debt payments divided by gross income before tax expressed as a percentage usually on either a monthly or annual basis. Debt-to-income ratio DTI is a percentage that compares your total debts with your income. Web To calculate your debt-to-income ratio add up all of your monthly debts rent or mortgage payments student loans personal loans auto loans credit card payments.

Choose a longer time period to pay off your. Ad 30 Year Mortgage Rates Compared. But each mortgage lender can set its own eligibility requirements and DTI.

Web 2 days ago30-year fixed mortgage rates. Web 2 days agoThe current average interest rate on a 30-year fixed-rate jumbo mortgage is 705 008 down from last week. Compare Now Save.

Ad Take Advantage of Low Fixed Mortgage Rates Before Its Too Late. 2022s Top Mortgage Lenders. Select Apply In Minutes.

Web As a rule of thumb you want to aim for a debt-to-income ratio of around 36 or less but no higher than 43. Ideally lenders prefer a debt-to-income ratio. Ad Take Advantage of Low Fixed Mortgage Rates Before Its Too Late.

1 2 For example. Web To calculate debt-to-income ratio divide your total monthly debt obligations including rent or mortgage student loan payments auto loan payments and credit card. Heres how lenders typically view DTI.

5875 down from 6125. Web Generally a good debt-to-income ratiois around 36 or less and not higher than 43. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online.

Compare Now Save. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Web These updated pricing grids include the upfront fee eliminations announced in October 2022 to increase pricing support for purchase borrowers limited by income or.

Nerdwallet it makes it easy to find personal loans and get the cash you need. Web Your debt-to-income DTI ratio and credit history are two important financial health factors lenders consider when determining if they will lend you money. Select Apply In Minutes.

Web As a general guideline 43 is the highest DTI ratio a borrower can have and still get qualified for a mortgage. Web Your debt-to-income DTI ratio is the percentage of gross income before taxes are taken out that goes toward your debt. 2022s Top Mortgage Lenders.

The 30-year jumbo mortgage rate had a 52-week.

Mortgage Lender Woes Wolf Street

The 30 30 3 Home Buying Rule To Follow Financial Samurai

Borrowers Save Chip Jewell Mortgage Loan Officer

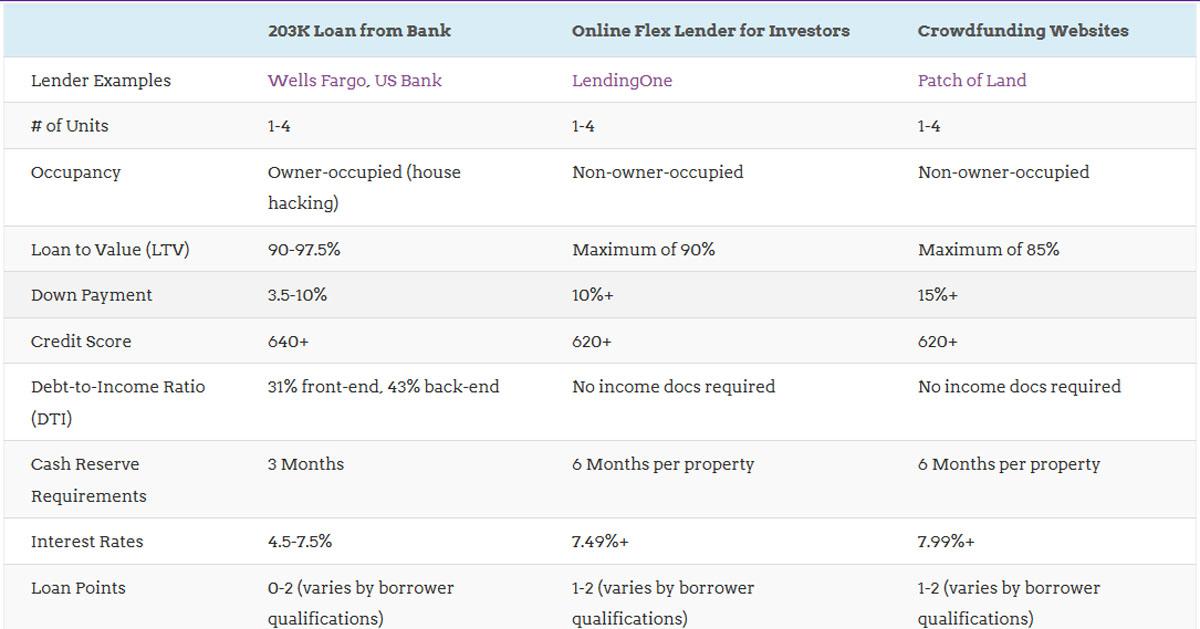

Compare Investment Property Loans Rental Property Mortgage Rates

What S Considered A Good Debt To Income Dti Ratio

Economic Impacts Of The Covid 19 Crisis Evidence From Credit And Debt Of Older Adults Journal Of Pension Economics Finance Cambridge Core

How Debt And Income Affects Mortgage Affordability Homewise

How To Pay Off The Mortgage Early 30 Methods You Can Use Right Now

Calculated Risk Update Household Debt Service Ratio At Lowest Level In 30 Years

.jpg)

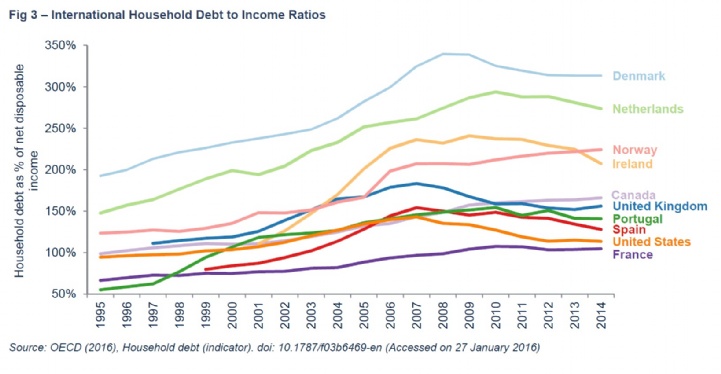

Savills Usa Household Debt

Debt To Income Ratio To Be Able To Qualify For A Mortgage

What Is Debt To Income Ratio Synergy Credit Services

What Is A Good Debt To Income Dti Ratio

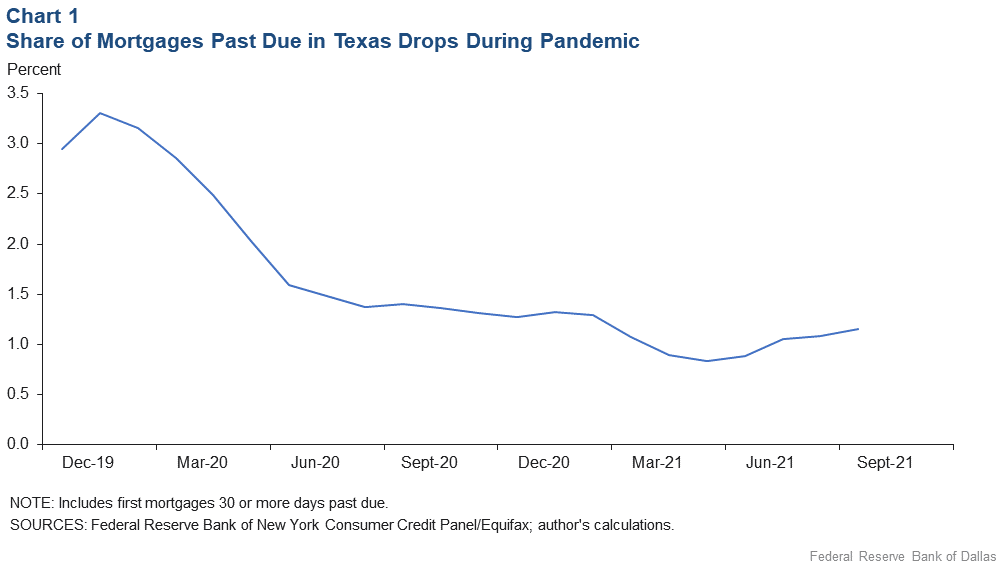

Pandemic Mortgage Relief Headed Off Delinquencies But What Happens Now Dallasfed Org

What Is A Good Debt To Income Ratio For A Mortgage Eric Wilson

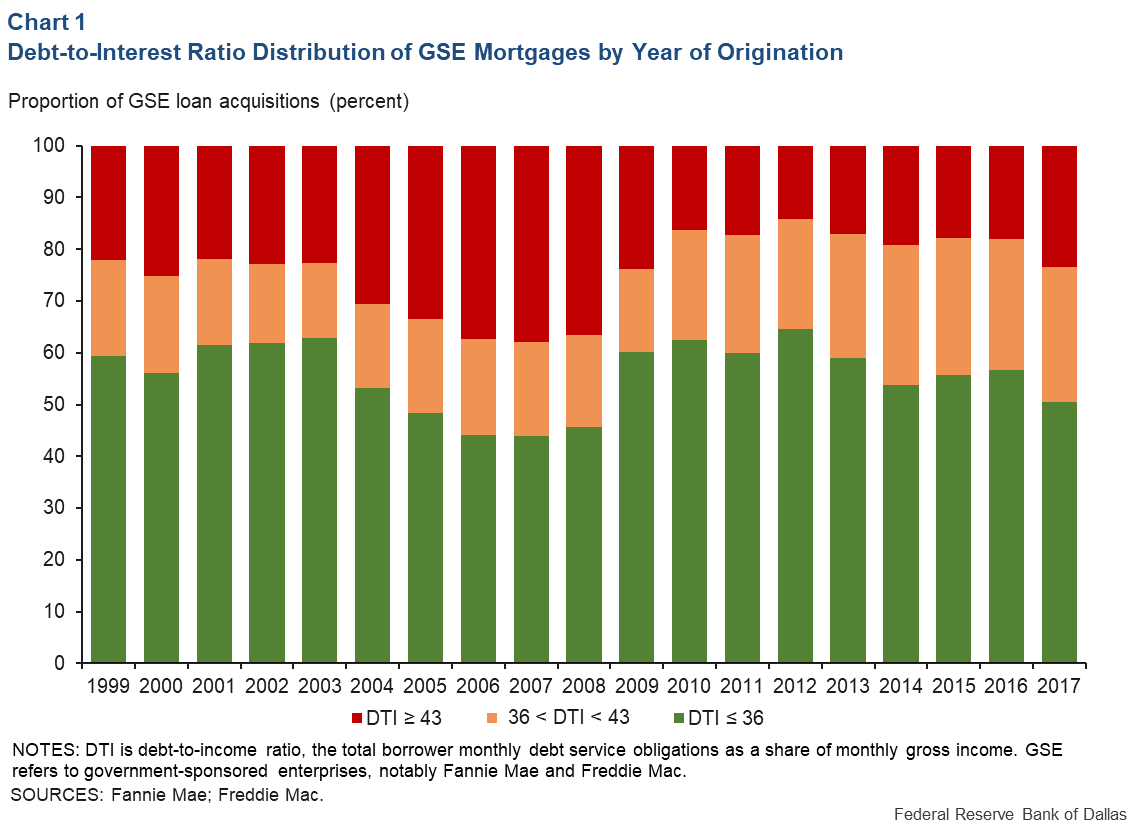

Ability To Repay A Mortgage Assessing The Relationship Between Default Debt To Income Dallasfed Org

Need A Mortgage Keep Debt Levels In Check The New York Times